Federal Reserve maintains interest rates amid 'sticky' inflation concerns

- Layne McDonald

- 21 hours ago

- 4 min read

Quick Context

What happened? The Federal Reserve held its benchmark interest rate at 3.5%–3.75% on February 6, 2026, pausing its rate-cutting cycle after three consecutive cuts in 2025.

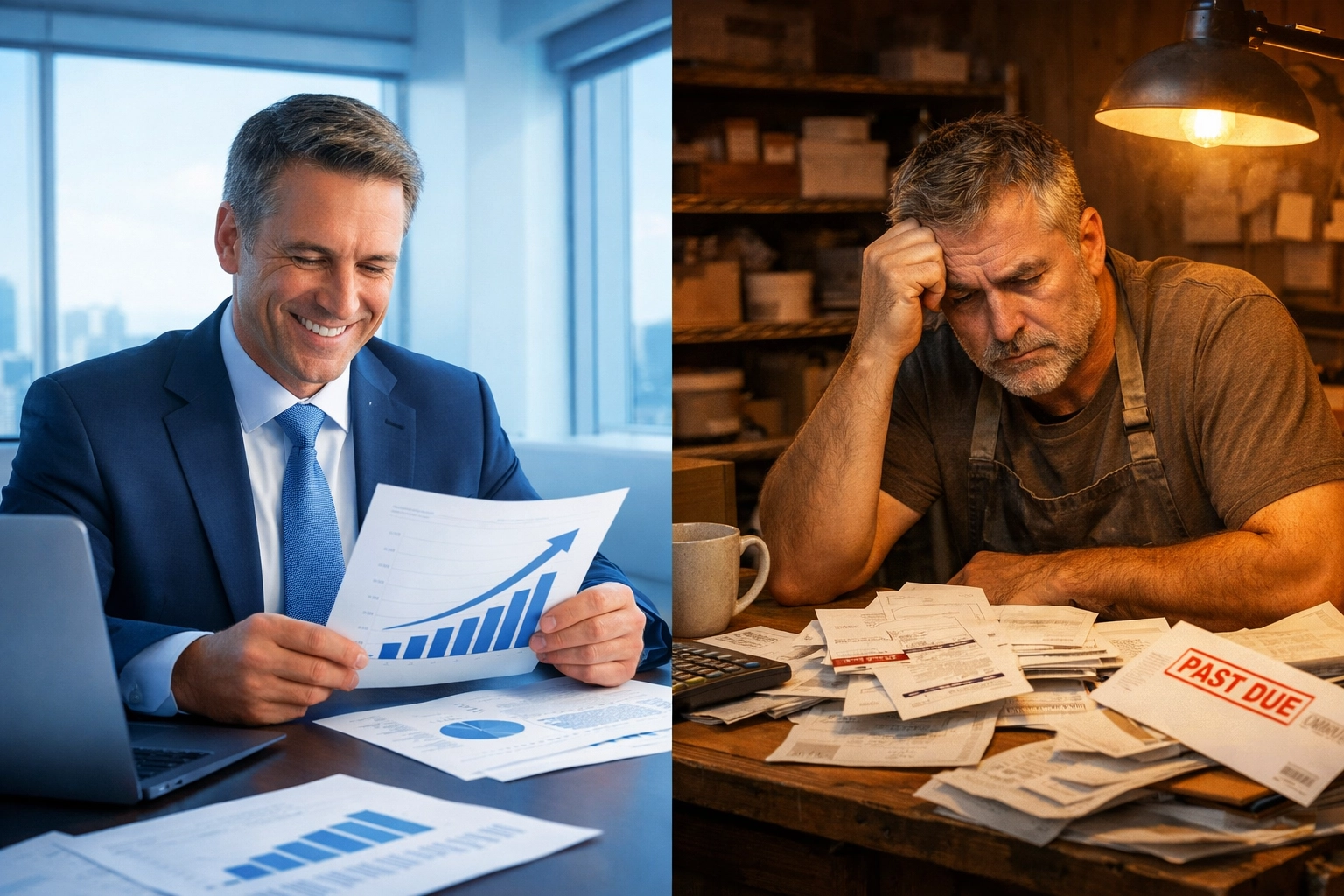

Why does it matter? This decision affects borrowing costs for mortgages, business loans, and credit cards: impacting families, small businesses, and anyone navigating financial stress.

What's the tension? Inflation remains above the Fed's target, but holding rates higher for too long could strain households and smaller businesses already facing elevated costs.

Where does faith meet economics? Scripture calls us to seek wise counsel in uncertain times and to anchor our peace in God rather than market movements.

The Facts

On February 6, 2026, the Federal Reserve announced it would maintain its benchmark interest rate between 3.5% and 3.75%. This marks a pause in the central bank's rate-cutting cycle, which saw three consecutive reductions in 2025.

Chair Jerome Powell stated that the U.S. economy remains stronger than anticipated, with economic activity expanding at a solid pace and unemployment showing signs of stabilization. However, inflation continues to run above the Federal Reserve's target level, a condition Powell described as "sticky."

Powell emphasized the Fed's commitment to political independence during the announcement, reaffirming that monetary policy decisions are made based on economic data rather than political pressures.

The decision to hold rates follows a period in 2025 when the Fed lowered rates, helping to bring mortgage rates down significantly. As of early February 2026, 30-year mortgage rates averaged approximately 6.00%–6.27%, offering more favorable conditions compared to the near-7% rates seen throughout much of 2024.

Market analysts currently expect only one 25-basis-point rate cut in 2026, with many predicting it could occur in June. The Federal Reserve has indicated it will carefully assess incoming economic data before making any additional adjustments to interest rates.

Different Perspectives

Those who support the Fed's decision to hold rates argue that maintaining the current level prevents the economy from overheating while allowing inflation to continue cooling. They point to the stronger-than-expected economic activity as evidence that the economy can handle current borrowing costs without tipping into recession. Proponents believe patience now will lead to more sustainable long-term growth and price stability.

Critics of keeping rates at this level worry that prolonged higher borrowing costs could strain smaller businesses and families who are already struggling with elevated living expenses. They argue that while inflation remains above target, it has cooled significantly from its peak, and the Fed risks overcorrecting by holding rates too high for too long. These voices express concern that small business owners facing higher loan costs and families managing credit card debt or seeking to purchase homes may face unnecessary hardship.

Both perspectives acknowledge the complexity of the Federal Reserve's mandate: balancing inflation control with employment and economic growth. The tension lies in determining when rates are "just right": high enough to keep inflation in check but not so high that they choke economic opportunity for everyday people.

A Biblical Lens

Economic policy can feel abstract, but for many families and business owners, interest rate decisions have direct, personal consequences. When we face seasons of financial uncertainty: whether from rising costs, stagnant wages, or unpredictable policy shifts: Scripture offers grounding.

Proverbs 11:14 reminds us: "Where there is no guidance, a people falls, but in an abundance of counselors there is safety." This principle applies both to national economic leadership and to our personal financial decisions. Wise guidance matters. Complex economic moments require thoughtful counsel, not reactive decision-making based on fear or speculation.

The Federal Reserve's deliberate, data-driven approach reflects the value of measured wisdom rather than impulsive action. Whether we agree with every decision or not, we can appreciate the principle that complicated times call for careful discernment.

At the same time, we are called to recognize the limits of monetary policy: or any earthly system: to provide ultimate security. Hebrews 13:5 instructs: "Keep your life free from love of money, and be content with what you have, for he has said, 'I will never leave you nor forsake you.'"

This doesn't mean we ignore practical financial stewardship or stop caring about economic justice. It means our peace isn't held hostage by interest rate announcements or inflation reports. God's presence is steady when markets are not.

For those feeling the weight of financial stress: whether you're a small business owner watching loan costs, a family trying to save for a home, or someone juggling rising expenses: there is an invitation to bring that burden to the One who sees and cares.

Finding Center in Financial Seasons

Economic headlines can stir anxiety, especially when they directly affect our wallets and our ability to plan for the future. It's easy to feel caught between forces beyond our control: inflation, interest rates, wages, housing costs.

But there is a way to walk through these seasons without being consumed by fear or bitterness. It starts with remembering that our ultimate security is not found in favorable monetary policy or perfect market conditions. It's found in the character of a God who provides, who sees, and who walks with His people through uncertain terrain.

This doesn't mean pretending financial stress isn't real. It means choosing to process that stress from a place of peace rather than panic. It means seeking wise counsel: for your finances, your business, your family decisions: while anchoring your heart in something more stable than the Federal Reserve's next move.

Wisdom, contentment, and God-centered leadership are possible even when the economy feels complicated. Jesus invites us to bring our anxieties to Him, to seek His guidance in practical decisions, and to trust that He is present in every season: whether rates go up, down, or stay flat.

If you find yourself needing a steady voice to help you process financial stress or navigate big decisions without losing your peace, I'd love to walk with you. You can find me at www.laynemcdonald.com: it's a space for coaching and mentoring when you need help finding your center in seasons like this.

The Federal Reserve will continue making decisions based on economic data, and headlines will keep shifting. But your peace doesn't have to shift with them. There is a better anchor.

$50

Product Title

Product Details goes here with the simple product description and more information can be seen by clicking the see more button. Product Details goes here with the simple product description and more information can be seen by clicking the see more button

$50

Product Title

Product Details goes here with the simple product description and more information can be seen by clicking the see more button. Product Details goes here with the simple product description and more information can be seen by clicking the see more button.

$50

Product Title

Product Details goes here with the simple product description and more information can be seen by clicking the see more button. Product Details goes here with the simple product description and more information can be seen by clicking the see more button.

Comments